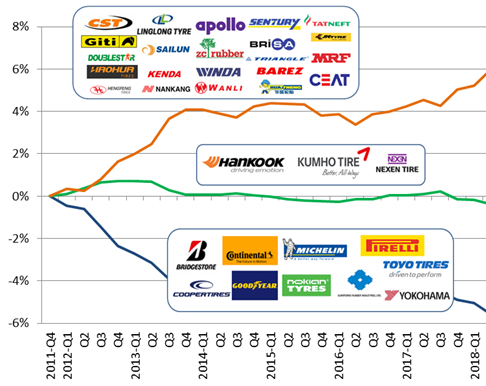

Global passenger tire sales market share changes in 8 years

The latest global tire market share report provided by Astutus Research shows that the market share of some tire companies has declined, and some has increased early. Since the end of 2011, the ten leading car tire manufacturers located in Japan, Europe and North America (JE-NA) have lost a total of nearly 6 percentage points of market share. In a way, this reflects the strategic choice of some companies to focus on the higher-value premium tire market. Besides, it can be seen from the chart that the changes of Korean tires from 2011 to 2018 were not obvious, and they developed in a straight line.

Looking at the top 21 tire companies, the market share has increased by 6 percentage points in these 8 years. In other words, the market share lost by European, American and Japanese tire companies has been divided by these 21 tire companies. Of these 21 tire companies, Chinese tires account for the vast majority.

During these 8 years, although the tire market in China is a shuffle period, many domestic large and medium-sized tire companies have closed down, but at the same time, those Chinese leading tire companies are also expanding rapidly, opening the door of foreign tire markets quickly.

With the establishment of the first foreign factory of a Chinese tire company by Sailun, a wave of going abroad to set up factories was set off in China. Zhongce Rubber and Linglong Tire followed closely behind. This year, the joint venture plant of Sailun and Cooper is about to start production. The Pakistan plant of Qingdao Shuangxing is under construction, and the construction of Chaoyang Langma’s overseas plant is also on the horizon.

In contrast, the actions of foreign tire companies are quite different from domestic tire companies. Korean tire companies have disappeared in recent years, and no particularly large decisions have taken place. And foreign tire companies are closing factories one by one.

Michelin has announced several times this year that it plans to close a truck tire plant in La Roche-sur-Yon, France, by the end of 2020. Michelin said that the plant was closed because of the “structural transformation” of the premium truck tire market in Europe and overseas markets. The structural transformation affecting truck tires is mainly due to the lack of growth expectations in the European market and fierce competition. The closure of the plant was opposed by some workers.

But we also see that foreign tire companies are gradually phasing out small-size tires and gradually expanding the production capacity of large-size tires.

Goodyear is the first to carry out a restructuring plan in Germany this year. For the two local factories, on the one hand, it will increase the annual production capacity of 2.5 million tires of 17 inches; at the same time, reducing capacity for smaller, less profitable tires. On the other hand, they strive to improve business by reducing staff and increasing efficiency. It is expected that by 2022, operating income will be increased from 60 million US dollars to 70 million US dollars, while reducing about 1,100 jobs.

Bridgestone has been cautious in 2019, and announced in June that it would invest USD 36 million to transform and upgrade eight European factories in Poland, Hungary, Spain, Italy, and France in four years.

Due to the deterioration of the market environment, some companies have also postponed or cancelled their investment plans. Hankook Tire has postponed investments in its Hungary plant of up to approximately 268 million euros. The plan was launched in 2018 and aims to expand the capacity of truck and bus tires based on the existing plant. Hanbkok Tire said that the sluggish car sales situation is one of the reasons for delaying the project. In the future, Hankook Tire will conduct strategic analysis from a longer-term perspective, and the elongation of all investments will be more stringent.

The global tire market was worth 3.1 Billion Units in 2018, growing at a CAGR of 4.3% during 2011-2018. According to the report, the market is anticipated to reach a volume of 3.9 Billion Units by 2024.

Various factors such as rapid urbanization, changing lifestyles, mounting income levels and rising population have led to an increase in the sales of both commercial and passenger vehicles.

Strong growth in the automotive industry is directly influencing the sales of tires across the globe. Moreover, increasing investments in the construction sector, the thriving tourism industry and rising vehicle motorization rates are positively impacting the production of commercial vehicles, thereby boosting the growth of the market.

Apart from this, manufacturers are now engaging in the development of products such as ecological tires, flat run tires and nitrogen-based tires that are environment-friendly. For instance, they are employing orange peel extracts in the production to diminish petroleum usage.

Contact us today for more information

Your Product liability experts in the tire

and motorsports industries

Tiger Chen

Tiger Chen