How does insurance company make money?

- Case 1, one tire manufacturer annual premium is about $432,000, and they had a loss in the same year and incur total loss about $2,918,000. The ROI is 575%.

- Case 2, one tire manufacturer annual premium is about $242,000, and they had a loss in the same year and incur total loss about $650,000. The ROI is 192%.

- Case 3, one tire manufacturer annual premium is about $285,000, and they had a loss in the same year and incur total loss about $12,939,000. The ROI is 4440%.

Have you ever wondered how the insurance companies operate? The premium you pay is just a fraction of what insurance company pays on your behalf for the claim. How do they even make money? How are they even in business and a quite profitable one at that?

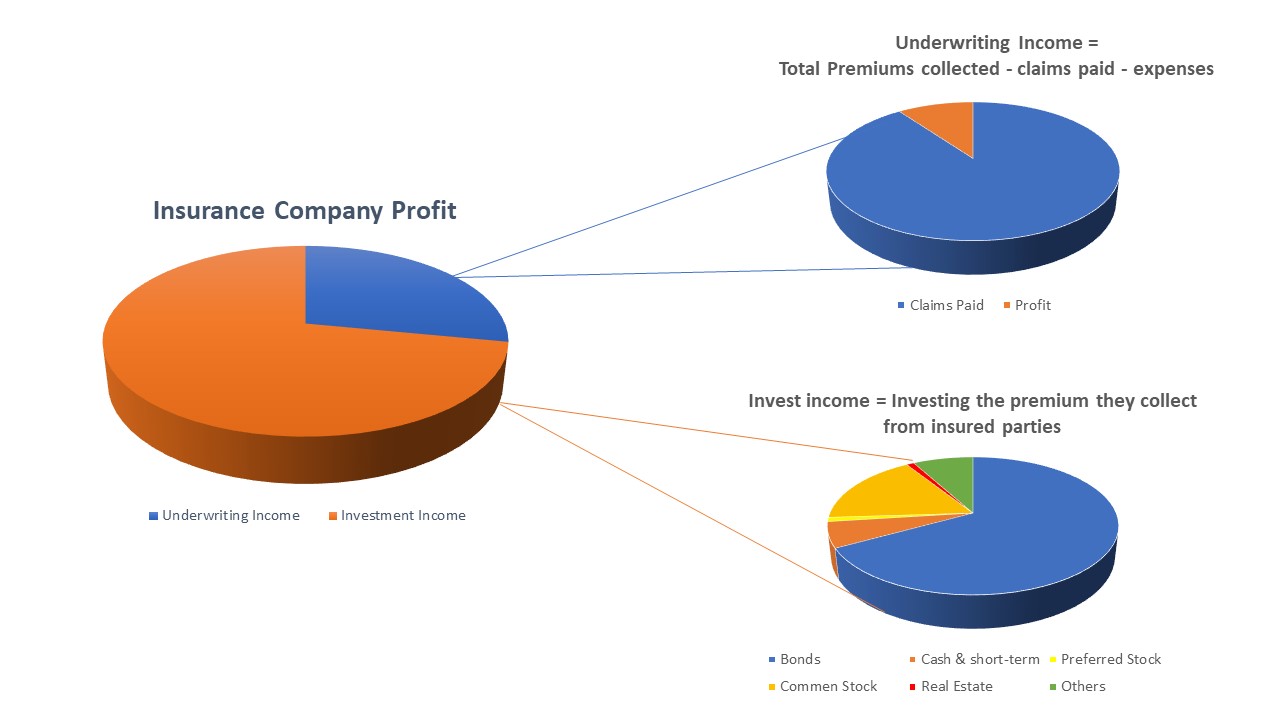

How Do Insurance Companies Make Money?

An insurance company essentially pools the premiums together from its customers. When one of those customers’ needs payment for a claim, the insurance company uses money from the pool to pay the claims. An insurer will also use premiums to pay for its operational costs. Any money left after expenses and claims are paid is considered income. Premiums Collected – Claims Paid – Expenses= Profit.

Insurance company use the premium leftover in the pool and place them into financial investments. The money earned on these investments contributes to the insurance company’s income.

How to turn your insurance cost to an incoming revenue source?

We have a national program structured like how insurance companies work. By participating, your premium will be invested similarly to how the insurance companies operate.

The next step is to qualify you for the program. Your premium is no longer is cost. It will be part of your asset.

Contact us today for more information

Your Product liability experts in the tire

and motorsports industries

Tiger Chen

Tiger Chen