Retail & Wholesale

WHOLESALE/ RETAIL/ DISTRIBUTORS

Warehouse management, supply chain interruption are the most critical issues for wholesale businesses. Our team provides solutions to develop coverage using industry analytics to benchmark your business insurance and put you in control.

The results: clearly understanding of your risk management

program, lower operational costs, and decreased volatility.

For our wholesalers and distributors, we offer:

Contact us today for more information

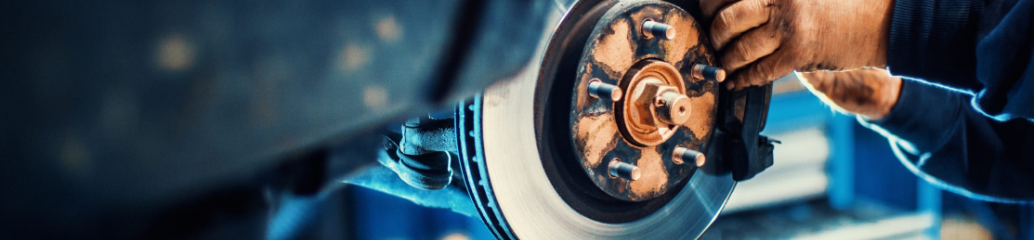

Your Product liability experts in the tire and motorsports industries